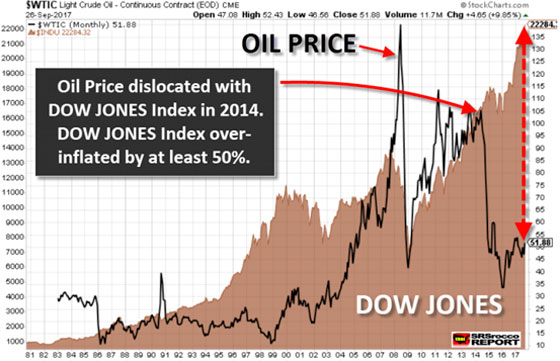

As Americans place a record amount of bets into a stock market that continues to rise towards the heavens, few realize how much the Dow Jones Index is overvalued. While some metrics suggest that the Dow Jones Index is very expensive, there is another indicator that shows just how much of a bubble the market has become.

If we compare the Dow Jones Index to the price of oil, we can see how much the market has to fall to get back to a more realistic valuation. For example, if the Dow Jones Index were to decline to the same ratio to oil back to its low in early 2009, it would need to lose 14,500 points or 65% of its value.

To get an idea just how overvalued the Dow Jones is compared to the price of oil, look at the chart below:

The oil price (BLACK line) increased with the Dow Jones Index

...

Read more »