8:14 AM THE UNKNOWN FUNDAMENTAL: This Will Push The Silver Price Up Much Higher | |

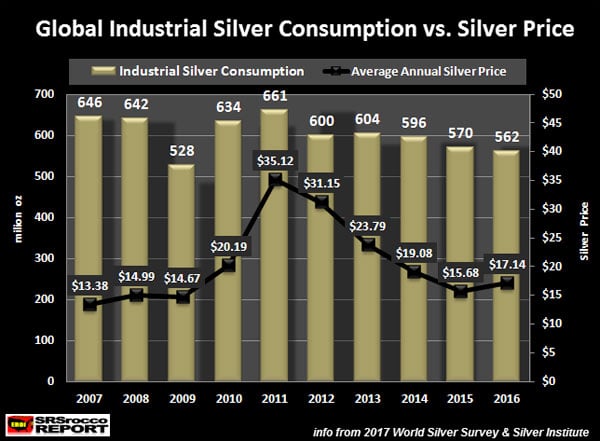

Precious metals investors need to understand the coming silver price surge will not occur due to the typical supply and demand forces. While Mainstream analysts continue to generate silver price forecasts based on supply and demand factors, they fail to include one of the most important key forces. Unfortunately, the top paid Wall Street analysts haven’t figured it out that supply and demand forces don’t impact the silver price all that much. For example, I continue to read articles by analysts who suggest that industrial demand will impact the silver price in the future. They believe that rising industrial silver demand should push prices higher while lower demand would do the opposite. However, according to my research, I don’t see any real correlation. So, why should industrial demand impact the silver price in the future when it hasn’t in the past? If we look at the following chart, there doesn’t seem to be a correlation between global industrial silver demand and the silver price:

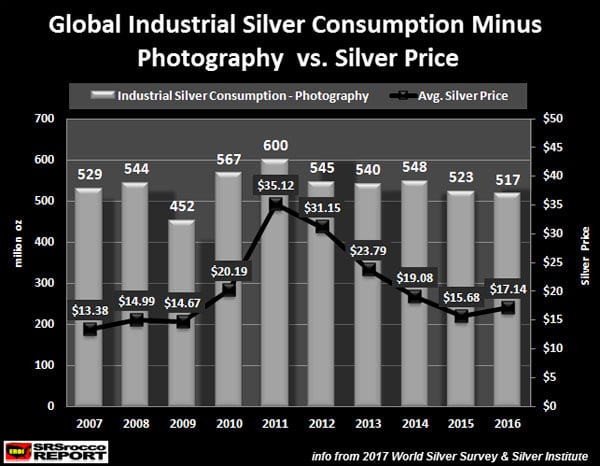

Here we can see that industrial silver demand only increased 17 million oz (Moz) in 2011 compared to 2008. However, the price more than doubled from $14.99 to $35.12. On the other hand, as the silver price fell in half in 2015 versus 2012, industrial silver demand only declined by 30 Moz (600 Moz down to 570 Moz). Thus, rising or falling industrial silver demand isn’t a factor that determines the silver market price. Also, many analysts have suggested that a falling silver price would generate more industrial consumption. Unfortunately, as the silver price peaked and declined in 2011, so has industrial demand. Now, some readers may believe that the decline in industrial silver consumption is due to less silver being used in photographic applications. While this is partially true, if we remove photographic silver usage from industrial demand, we can plainly see that industrial consumption of 529 Moz in 2007 was higher than the 517 Moz in 2016:

Regardless, forecasts for industrial silver consumption have been consistently wrong. In an article I wrote back in 2014, I stated the following on industrial silver demand: I have always stated that industrial silver demand, especially solar power demand, will not be much of determining factor in setting the price in the future. Wall Street analysts continue to regurgitate that industrial silver demand will grow for the next 5-10 years. Hogwash. When the peak of global oil production takes place within the next several years, this will impact Global GDP growth. Matter-a-fact, world economic activity will contract along with the decline in global oil production. Which means, demand for silver in industrial applications will decline as well.

Continue reading... (source) | |

|

| |

| Total comments: 0 | |