4:18 PM Cannibalization of the Financial System Will Force Investors into Silver | |

| By looking at the symptoms taking place in the financial system, we can see just how bad the situation is becoming.

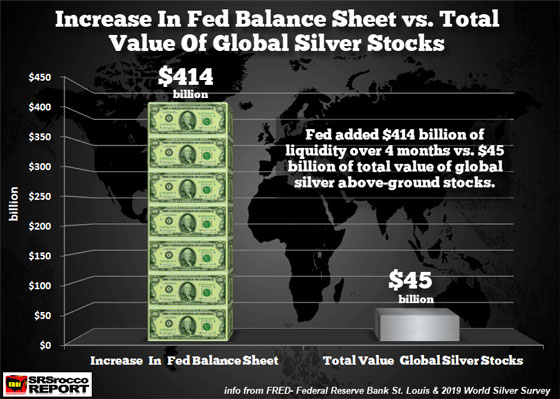

The chart below shows the amount of asset purchases the Federal Reserve has added to its balance sheet over the past four months versus the total value of all global above-ground silver stocks:

I decided to compare the Fed’s balance sheet to silver rather than gold because I believe silver will be the GO TO ASSET once investors get PRECIOUS METALS RELIGION. Silver’s future price action or value will make Palladium’s current bubble look tame indeed. Unfortunately, Palladium’s value will crash once the global economy heads into a depression. Even though Palladium and Platinum are precious metals, the overwhelming majority of investment demand is in silver and gold. Palladium and Platinum’s value is based more on industrial demand rather than investment demand. KISS – Keep It Simple Stupid. Acquire the 2,000+ year history of money… gold and silver. In the last four months, the Federal Reserve added $414 billion to its balance sheet. What a change compared to the $708 billion in assets the Fed sold back to the market (primary dealers) over a two-year period.

Article source: http://bit.ly/2vcHaz5 | |

|

| |

| Total comments: 0 | |