9:30 AM Why U.S. GDP Hasn’t Really Increased Since 2000 | |

While official sources forecast U.S. Gross Domestic Product (GDP) to surpass $20 trillion this year, the real figure is probably much less. So how much less is real U.S. GDP? Well, that depends on how it is measured. If we factor in energy consumption and the increase in total public debt, U.S. GDP is likely less than half of the current figure.

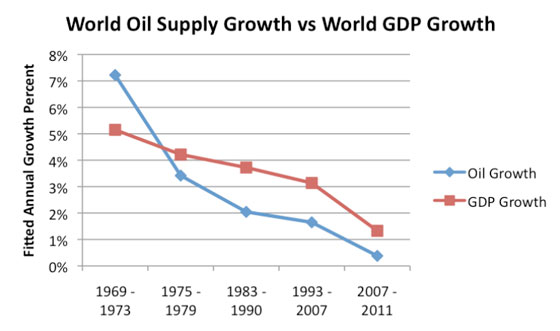

Yes, it sounds insane to say that the current U.S. GDP is likely overstated by at least 50%, but if we go by fundamental data, it isn’t that crazy at all. Unfortunately, Americans have been conditioned to believe that money grows on trees and energy comes from the Wizard of Oz. Thus, if we need more money, then the U.S. Treasury can print more Federal Reserve Notes, or we can swipe the credit card. And, if we need electricity, we just switch on the light. Easy… Peasy. Due to the highly complex nature of the world in which we live in today, the individual is clueless as to the tremendous amount of energy and work that it takes to produce the foods we eat and the goods, energy, and materials we consume. So, it should be no surprise that U.S. GDP can be overstated by 50%+. If we go by the data that shows the growth of Global GDP is related to the growth of Global Oil Supply, then it is very quite easy to spot inflated GDP figures. However, you have to be able to understand this essential ENERGY=GDP relationship. Of course, this is not taught in business or economic classes in high school or college. Instead, the economic teachers focus on the insane theory of SUPPLY vs. DEMAND. If individuals are taught GARBAGE, then their thinking and reasoning is GARBAGE. So, we really can’t blame them. In looking at the following chart by Gail Tverberg, the increase in Global GDP corresponds to the rise in Global Oil Supply:

As the annual growth percentage of World Oil Supply declined in the periods shown in the chart above, the same trend took place in World GDP. If we can understand the OIL-GDP relationship figures in the chart, then it is impossible for a country to grow its GDP if it does not increase its energy consumption. Continue reading (source)

| |

|

| |

| Total comments: 0 | |