8:53 AM Why Gold Is The King Monetary Asset, Not Bitcoin | |

There seems to be a lot of misinformation being peddled on the internet about gold and bitcoin. One major misconception is the notion that bitcoin will replace gold as a monetary instrument. Some analysts, once stanch precious metals advocates now turned crypto aficionados, believe in such theories that there is too much gold in the world to be used as money or that it is now just a barbarous relic. Just a year or so ago, these same supposed analysts were criticizing the Mainstream media financial network talking heads for calling gold as a barbarous relic, but now have jumped on the bandwagon.

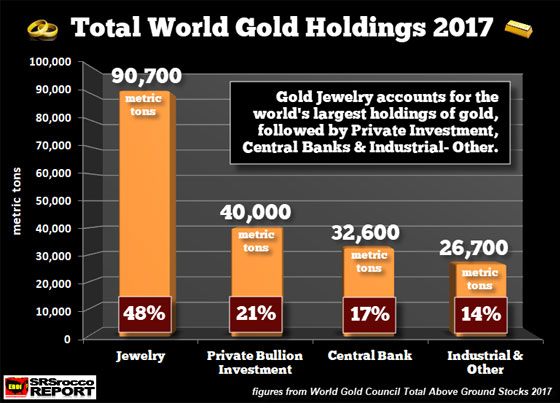

Well, in one small way, who can blame them. It has been frustrating holding onto gold and silver patiently waiting for their inevitable rise. So, when Bitcoin and the crypto prices moved up exponentially last year, promising investors vast riches in the future, it was easy for many to drop the precious metals and move into the crypto market. The mindset today is to make lots of money doing nothing. Thus, it’s not surprising to see many fall into this delusion and way of thinking. A few of the crypto aficionados tell their followers that gold can’t be a monetary asset because there are millions of tons of gold hidden in secret vaults or that there are billions of ounces locked away in the Grand Canyon. While this may sound like quite an interesting conspiracy, there is no sound evidence to back it up. To believe in these fanciful conspiracies defies all logic. However, with logic being in short supply currently, I am not surprised that many believe in these fairy tales. One of these ex-precious metals, now a highly qualified cryptoanalyst, suggested in a recent video that the “Gold is owned by the Bankers” so why would you want to own gold? Unfortunately, this is a false statement. While the Central banks own a lot of gold, it’s a lot less than what the private investors and jewelry owners hold. According to the World Gold Council, jewelry accounted for the largest stocks of above ground gold at 90,700 metric tons (mt), followed by 40,000 mt of private investment, 32,600 mt of Central bank holdings and 26,700 mt of Industrial usage and other:

Of the total 190,000 mt of the world above ground gold stocks, jewelry consists of 48%, private investment 21%, Central bank 17%, and Industrial and other at 14% (Source: World Gold Council – Total above-ground stocks 2017) So, if we realize that nearly half of all above-ground gold stocks are in the form of jewelry, and then another 21% is owned by private investors, Central banks DO NOT own most of the gold. Even if we compare private investment to Official holdings, private investors own more gold than Central banks. Continue reading (source)

| |

|

| |

| Total comments: 0 | |