9:42 AM U.S. Government Financial Balance Sheet One Step Closer To Blowing Up | |

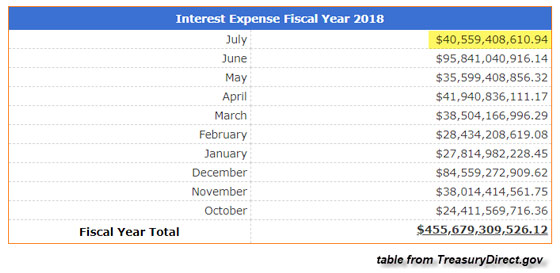

The U.S. Government’s balance sheet is one step closer to blowing up as its debt, and interest expense hit new record highs. And when I say “new record highs,” I am not exaggerating. It’s been a while since I checked the data on the TreasuryDirect.gov website, but when I researched the figures for this article, I was quite surprised by just how quickly the numbers are rising. Thus, it’s also no wonder the stock markets continue to grind higher and higher because, without the U.S. Government’s unlimited check-writing ability, the markets would have collapsed years ago. So, to all the Keynesian wanna-be’s who believe the Central Banks can print our way to prosperity forever, please tap your shoes together three times and say, “Everything will be okay because I have my 401k.” Let’s get started with the tremendous surge in the U.S. Government interest expense. Well, it seems as if things are really starting to get crazy at the U.S. Treasury when its interest expense in July jumped by a whopping 41% year-over-year. That’s correct. The U.S. Government paid $40.5 billion in interest expense this July versus $28.7 billion for the same month last year. That is one heck of an increase. If we look at the following two tables, we can see that the percentage increase of the interest expense in July is much higher than the previous months:

The interest expense the U.S. Government paid in Apil, May, and June was up 22%, 28%, and 6% respectively versus the same months in 2017. However, July was up 41% compared to July last year. Furthermore, total U.S. interest expense in 2017 was $458 billion while the amount paid this year is $455 billion and we still have two months remaining.

Continue to the full article: https://goo.gl/Uwis6t | |

|

| |

| Total comments: 0 | |