3:13 PM SILVER INVESTMENT: Outperformed Gold In This Major Sector | |

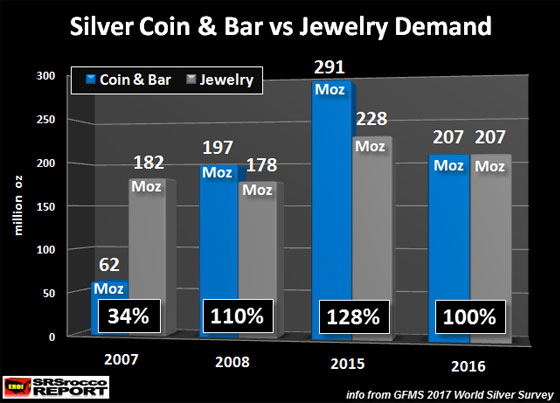

Precious metals investors may not be aware, but silver investment has seriously outperformed gold in this major market sector. Even though precious metals sentiment and sales are currently lower than they were over the past several years, this is only temporary pause before the market surges as the highly inflated stock market finally cracks and plunges lower. When we start to witness a huge correction or crash in the broader stock markets, there only be a few physical assets worth owning to protect wealth. Investors moving into the precious metals at this time, will see their asset values increase significantly. However, silver will likely out perform gold as investors and speculators move into the more undervalued precious metal. Actually, we have already witnessed this as physical silver investment versus jewelry demand has outperformed gold in the same market. Let me explain. While industrial demand is the largest consumer of silver in the market, silver jewelry demand has ranked second for quite some time. But, this all changed after the 2008 U.S. Banking Industry and Housing Market collapse. For example, global silver jewelry demand in 2007 was 182 million oz (Moz) versus 62 Moz in silver bar and coin demand. Thus, physical silver bar and coin demand was only 34% of world silver jewelry demand:

However, during the U.S. market meltdown in 2008, physical silver bar and coin investment surged more than three times to 197 Moz, while silver jewelry demand stayed flat at 178 Moz. In just one year (2007 to 2008), physical silver investment accounted for 110% of global silver jewelry demand. While silver investment demand fluctuated over the next seven years, it hit a record high of 291 Moz in 2015 as investors took advantage of low prices not seen since 2009. As physical silver bar and coin demand reached a new record in 2015, accounting for 128% of global jewelry demand that year. Even though physical silver demand declined in 2016, it was still neck and neck with jewelry demand of 207 Moz each. Now, if we compare physical silver investment to jewelry demand versus gold, we can plainly see how silver has outperformed gold in this market. | |

|

| |

| Total comments: 0 | |