4:24 PM Silver Eagle Sales Surge In September As U.S. Mint Resumes Supply | |

|

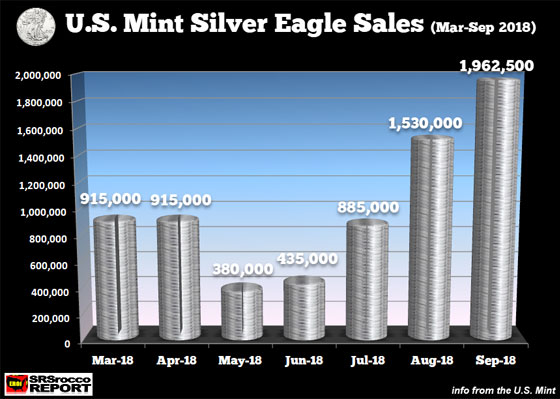

The sales of Silver Eagles surged in September as the U.S. Mint removed their temporary supply restriction. As the silver price continued to trend to new lows at the beginning of the month, several large purchases of Silver Eagles by the Authorized Dealers wiped out the inventory at the U.S. Mint. The U.S. Mint had cut back on its monthly supply due to the falling demand. However, now that the U.S. Mint has resumed sales of Silver Eagles, they have reached over 1.9 million, up 28% compared to August, and there are still ten days remaining in the month. Silver Eagle sales so far in September are the highest all year, except for the usual spike in January when the Authorized Dealers are stocking up on the newly released coin. As we can see in the chart below, Silver Eagle sales have jumped in August and September due to the lower silver spot price:

According to the figures released by the U.S. Mint, Silver Eagle sales fell to a low of only 380,000 in May. However, sales started to pick up in July and have continued to increase each month. Interestingly, Silver Eagle sales in the two months of August and September are about the same for the previous five months. Total sales of Silver Eagles to date in 2018 are 11.2 million. The total cost to purchase these 11.2 million Silver Eagles at a $20, would equal $224 million. Now, I just used a round $20 figure; the actual cost is likely a bit less. However, I wanted to compare the Silver Eagle market to the increase in U.S. public debt since August 1st.

Full Article: https://goo.gl/MMMF2g | |

|

| |

| Total comments: 0 | |