11:19 AM Palladium Prices Are Exploding – Here’s Why It Matters... | |

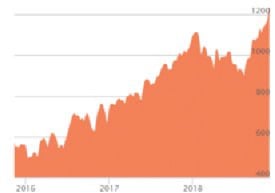

The precious metals sector has just one standout performer this year, and that is palladium. Lately the market for that metal has gotten more than just hot. Developments there could have implications for the LBMA and the rickety fractional reserve system of inventory underpinning all of the physical precious metals markets. Palladium Reaches Gold Price, Makes All-Time High Craig Hemke of the TF Metals Report was Money Metals’ podcast guest this past Friday. He has been watching the developments in palladium closely and gave an excellent summary of what's involved. Palladium prices went parabolic once before. The price went from under $400 per ounce to $1,100/oz from late 1999 to early 2001. Then, just as quickly, the price crashed back below $400. Palladium's move higher in recent months is reminiscent. It remains to be seen whether or not a price collapse will follow. Some of the underlying drivers are the same, some are not. Russia May Not Save the Palladium Markets This TimeToday, as in 2001, Russia is the world’s largest producer of the metal. Mines there contribute about 40% of the world supply. The shortage 17 years ago was driven by demand. Automobile and truck manufacturers began using more of the metal in catalytic converters. It was a lower cost alternative to platinum. When the market ran into shortage, Russians, under President Boris Yeltsin, rode to the rescue. They were willing and able to bring more physical metal to market. The added supply turned the market around just in the nick of time. The LBMA and bullion banks got away with selling way more paper palladium than they could actually deliver. Today, palladium inventory is once again in short supply. This time around, however, the paper sellers in London and in the COMEX may find themselves at the mercy of Vladimir Putin. Russian relations aren't what they were in 2001. Palladium users may not get the same rescue as before, assuming Russian miners have stockpiles to deliver.

Continue reading: https://goo.gl/D3gsHM | |

|

| |

| Total comments: 0 | |