4:05 PM How the Investor Fundamentally Changed the Silver Market | |

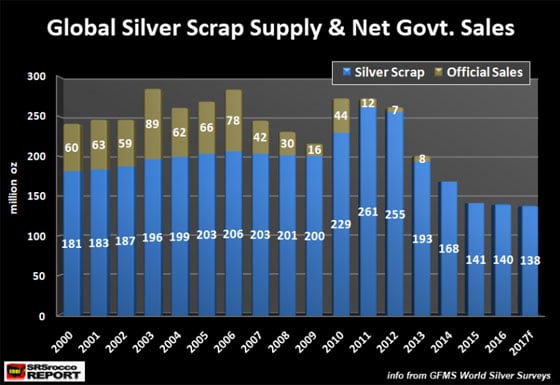

While silver investors continue to be discouraged about the low price, the market has experienced a fundamental change that needs to be understood. Ever since governments removed silver from official coinage, over 50 years ago, the market has been supplemented by several billion ounces of silver. The majority of that supply has been depleted. The reason the United States and other countries stopped producing official silver coinage wasn’t due to any monetary conspiracy; rather it was based on a straightforward problem; supply versus demand. Because industrial silver consumption had skyrocketed after World War 2, the silver market would have suffered deficits if the U.S. Treasury didn’t sell silver into the market. It was quite simple; there just wasn’t enough silver to go around. So, governments started to reduce, then eliminate silver from their coinage in the 1960’s. A lot of this silver, known as “junk silver,” was either purchased by investors or remelted and sold back as supply into the market. While there is no way of knowing how much of the older official junk silver remains in the market, the majority of it was recycled for much-needed supply. We can see the dwindling down of government stocks and older official silver coinage in the following chart:

The BLUE bars represent silver scrap supply, and the OLIVE colored bars show the amount of net government silver sales. From 2000 to 2013, governments sold 636 million oz (Moz) of silver into the market. Net government sales were from stockpiled silver and older official coins. However, in 2014, this supply totally dried up. For the past four years, there haven’t been any government silver sales. Another interesting aspect of this chart is the declining amount of silver scrap supply. Even though the price of silver during the 2015-2017 period was much higher than from 2000-2007, scrap supply is considerably less. For example, the price of silver in 2000 was $4.95 while global scrap supply was 181 Moz. However, the silver price has been three times higher (2015-2017), but the average scrap supply has been 140 Moz.

Continue to the full article (source) | |

|

| |

| Total comments: 0 | |