3:35 PM How Savvy Investors Do (and Don’t) Hedge against Inflation | |

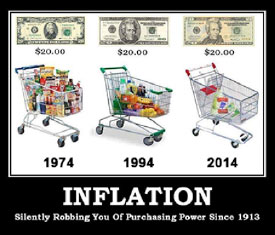

Inflation is a corrosive force that gradually – and sometimes rapidly – eats away at the nominal value of savings and investments. It is perhaps the biggest threat looming on the horizon for millions of retirees who have been steered into assets marketed as “conservative” – such as dollar-denominated money market accounts, bonds, and annuities.

According to the Aegon Retirement Readiness Survey 2018, an alarmingly large proportion of the population doesn’t understand basic financial concepts such as inflation. Consider this question from the survey: “Imagine that the interest rate on your savings account was 1 percent per year and inflation was 2 percent per year. After 1 year, how much would you be able to buy with the money in this account?” The question is actually even easier to answer than it first appears. To get it right you only have to select among a list of possible choices that includes “less than today,” “more than today,” and “the same as today.” Obviously, if inflation is running at 2% a year, then a 1% yield on your savings is neither growing nor preserving your purchasing power. The correct answer is “less than today.” That may be obvious to you. But it’s not to everyone. Among U.S. respondents, only 55% answered the inflation question correctly! A score of “55” is equivalent to an “F” – as a nation, we are outright failing to grasp the basic concept of how inflation negatively affects savings. Widespread public ignorance about inflation works, perversely, to the advantage of governments, central banks, commercial banks, and peddlers of fee-laden, inflation-lagging financial products such as fixed annuities. Investors who are savvy about the inflation threat know that conventional annuities, bonds, and savings accounts are all vulnerable to losing value in real terms. But those seeking protection from inflation can still run into trouble by venturing into flawed "inflation hedges." Think twice before sinking money into the following assets… Read the article here: https://www.moneymetals. | |

|

| |

| Total comments: 0 | |