3:49 PM Gold-Acquiring Foreign Powers Put Petro-Dollar in Jeopardy | |

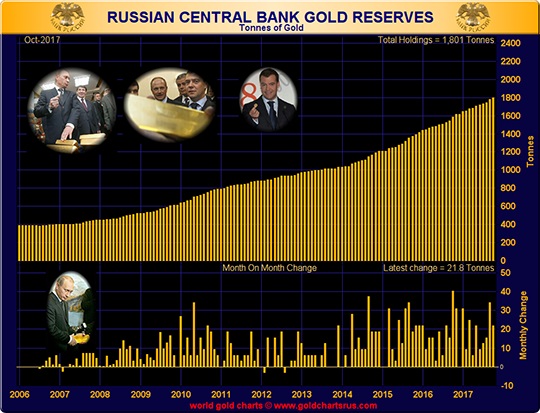

President Donald Trump’s administration is playing a game of high-stakes international chess with Russia, Iran, Turkey, China, and other countries viewed as adversaries in trade and geopolitics. It’s not necessarily the case that tariffs, sanctions, and blustering will result in a hot war. More likely, escalating strife between the U.S. and a bloc of much more populous adversaries will push them to unite more closely to undermine and ultimately dethrone King Dollar. The U.S. has long been the grandmaster – the dominant player on the geopolitical board – owing largely to its unique reserve currency status. Quite simply, the U.S. dollar is the go-to currency for world trade. Oil and gold are traded in dollars. Manufactured goods on the international market are traded in dollars. All other currencies are measured against the dollar. Nations Anxiously Moving to Dollar AlternativesBut all that is in the process of changing. As Washington, D.C.’s international adversaries pursue contra-dollar alliances, it could soon be checkmate for King Dollar. President Trump recently touted tariffs designed to punish Turkey. The tariffs triggered the biggest financial crisis Turkey has seen in decades. That may well have been the intended consequence. But the unintended consequence is that Turkey is now being pushed to form stronger economic ties with Iran… which in turn is forming stronger ties with Russia… which in turn is forming stronger ties with China.

The countries being targeted with tariffs and sanctions have a much larger combined GDP and a combined population that is multiples of the United States.’ What if a contra-dollar bloc formed that was determined to isolate the U.S. from the world financial system? Russian Deputy Foreign Minister Sergei Ryabkov recently told International Affairs, “The time has come when we need to go from words to actions and get rid of the dollar as a means of mutual settlements and look for other alternatives.”

Continue reading: (https://goo.gl/HpsXr3) | |

|

| |

| Total comments: 0 | |