10:58 AM EXAMINING SILVER MANIPULATION: What Some Analysts Miss | |

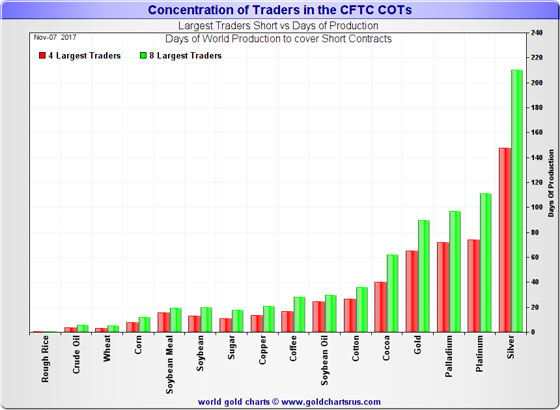

One of the major topics discussed in the precious metals community is the manipulation of the gold and silver prices by the large bullion banks. Many precious metals analysts point to the massive commercial short positions held by JP Morgan and Scotiabank as the root cause for the low silver price. While I agree that the bullion banks’ massive short contracts are controlling the silver price to a certain degree, there’s another factor that is overlooked by the majority of precious metals analysts. According to Ed Steers’ recent article titled, JPMorgan’s Silver Short Position Now At 195 Million Ounces, he stated the following: For the current reporting week, the Big 4 are short 148 days of world silver production-and the ‘5 through 8’ large traders are short an additional 62 days of world silver production-for a total of 210 days, which is seven months of world silver production, or about 510.3 million troy ounces of paper silver held short by the Big 8. [In the COT Report last week, the Big 8 were short 203 days of world silver production.]

As I also stated in the above COT Report, Ted pegs JPMorgan’s short position at about 39,000 contracts, or around 195 million troy ounces, which is up about 35 million troy ounces from what they were short in last week’s COT Report. 195 million ounces works out to around 80 days of world silver production that JPMorgan is short. That’s compared to the 210 days that the Big 8 are short in total. JPM is short about 38 percent of the entire short position held by the Big 8 traders. The two largest silver shorts on Planet Earth-JP Morgan and Canada’s Scotiabank-are short about 111 days of world silver production between the two of them-and that 111 days represents 75 percent of the length of the red bar in silver in the above chart... three quarters of it. The other two traders in the Big 4 category are short, on average, about 18.5 days of world silver production apiece, which is unchanged from last week — and the prior week. The four traders in the ‘5 through 8’ category are short, on average... 15.5 days of world silver production each, which is up a hair from last week’s COT Report. Ed Steer is making the point that two banks, JP Morgan and Scotiabank control approximately 53% of the 210 days worth of global silver production to cover these short positions. If we look at the chart above, we can clearly see that silver has the highest amount of short positions in days of a production compared to any other metal or commodity.

Continue reading (source) | |

|

| |

| Total comments: 0 | |