10:49 AM DEATH OF THE U.S. DOLLAR RESERVE CURRENCY... Picking Up Speed | |

The Death of the U.S. Dollar as the world’s reserve currency will have a profoundly negative impact on the lives of most Americans. Unfortunately, 99% of the population has no clue. The only reason 1% of U.S. citizens understand what is going on, is because the Mainstream media and financial networks have distorted the truth and the reality of our present situation. What happened in the markets today was a perfect example. Zerohedge published an article today titled, ‘Traders’ Panic-Buy Stocks, Shrug Off Nuclear Armaggedon, Debt Ceiling, & Biblical Flood Fears, and stating the following:

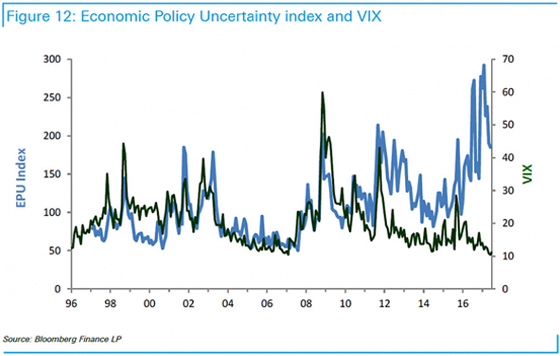

For a few brief hours overnight – until the bell rang at 0930ET on the NYSE – investors were anxious about North Korea’s most provocative yet missile launch, the terrible flooding disaster in Texas, and lest we forget, the looming debt ceiling debacle. But all of that was instantly forgotten as the machines took control and lifted stocks higher practically all day on a sea of USDJPY-ignited momentum. Looking at the chart above, we can see that when fear came into the markets during the North Korea missile incident and then the opening of the European markets (shown in the two red boxes), the Dow Jones Index fell as well as the USDJPY, while gold and the U.S. Treasurys increased. However, after the U.S. markets opened, MAGICALLY everything reversed because the nuclear threat with N. Korea, Biblical flooding in Texas and the upcoming debt ceiling issue no longer mattered. Those of us in the Alternative Media find this quite hilarious that nothing negatively impacts the financial markets anymore. Some have laughed while saying, “If a nuclear bomb had taken out New York City, the stock market would probably go up.” While I doubt that would happen, it is becoming a real joke to watch the financial markets today. I wrote about the insanity in the markets today and how it has negatively impacted the value of the precious metals in my recent article, The Reason Why Gold & Silver Have Frustrated Investors Since 2011. In the article I posted the chart below, by a Deutsche Bank analyst Aleksandar Kocic, on why the Markets Broke In 2012:

The description of the indicator above may be a bit difficult to understand so that I will simplify it. The BLUE LINE represents the “Economic Uncertainty Policy” (EPU index) shown by the frequency of articles in ten leading US newspapers that contain three of the target terms: economy, uncertainty; and one or more of Congress, deficit, Federal Reserve, legislation, regulation or White House in the mainstream media. The BLACK LINE is the VIX index, the volatility index (S&P 500). Economic uncertainty printed in articles in the Mainstream Media should correspond with the volatility indicator of the markets (the VIX). | |

|

| |

| Total comments: 0 | |