2:44 PM 2019 Money Metals Outlook | |

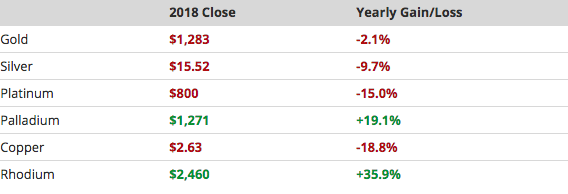

Precious metals markets enter 2019 with an opportunity to shine. Several major bullish drivers are lining up to start the New Year – including technical, fundamental, monetary, and political drivers. Before delving into each of them, let’s consider where we’ve been over the past 12 months. To be frank, 2018 wasn’t a particularly bright year for gold and silver prices. Gold will finish with a slight loss; silver with a larger loss just shy of 10%. It could have been worse. Sentiment toward metals got extremely depressed mid year. Speculators took out record short positions in the futures markets. Meanwhile, sales of American Eagles and other popular retail bullion products slowed to a trickle. By late summer, the money metals were making new yearly lows as the stock market headed for new record highs. But in September, the Fed went one hike too far. After monetary authorities pushed the Federal Funds Rate slightly above 2% (“neutral”), investors began to fear cascading negative effects in the housing, industrial, and consumer sectors. That fear – and the rotation out of stocks that followed – helped slowly reinvigorate safe-haven buying in precious metals. From late November through the end of the year, gold and silver prices rallied to multi-month highs. Momentum could carry forward to a strong first quarter of 2019.

Check it out here: https://goo.gl/de1Vgc | |

|

| |

| Total comments: 0 | |