|

Money Metals has gold and silver! In fact, while other dealers are sold out, we now have both metals at very low premiums (silver for $1 or less over spot, for example). Here’s what’s happening...

Many ... Read more » |

|

A huge spike in demand for physical precious metals has decimated available dealer inventories. The vast majority of gold and silver coins, rounds, and bars are either out of stock or come with extended shipping delays. Premiums are spiking higher. Dealers have raised bid premiums – the amount offered above the spot metal price – dramatically along with ask premiums.

The market is still searching for equilibrium and bids dealers pay may need to go even higher to entice enough sellers to meet demand. Demand continues to far outstrip available supply of minted items. The ... Read more »

Views:

69

|

|

Date:

20/03/23

|

|

The last few days have been like nothing most of us have ever experienced – or are likely to experience again in our lifetimes. Panic has spread from the streets of Wuhan to the grocery stores of America’s heartland, from nursing homes to the Federal Reserve Board, from the stock market to the gold and silver markets. Like other asset classes, the precious metals space is being rocked by rapidly accelerating developments, some of which haven’t occurred for decades and some of which haven’t occurred ever. These unprecedented times are testing the mettle of precious metals investors like never before. Gold and silver are meant to provide safe haven from financial turmoil. Safe haven demand for physical bullion has indeed surged. The pace of buying has been so furious in recent days that some dealers are literally running ... Read more »

Views:

102

|

|

Date:

20/03/17

|

|

Mike Gleason: It is my privilege now to welcome back our good friend David Morgan of The Morgan Report. David, it's always great to have you on and appreciate the time as always. How are you sir? David Morgan: Well, Mike, I am doing well personally and the markets aren't, but I'm hanging in there and thanks for having me on the show. Mike Gleason: Yeah, definitely overdue, and great to have you back. Well David, we are seeing tremendous volatility in markets. The coronavirus is getting the blame for a huge sell off in stocks and in epic rally and bond prices. Commodities, oil in particular, are getting hammered. Maybe the only thing predictable about the recent market action is the Fed's response. They did another emergency 50 basis point cuts and a lot of people expect them to cut another 50 basis points when the FOMC meets later this month. ... Read more »

Views:

115

|

|

Date:

20/03/16

|

|

As the coronavirus spreads fear, sickness, and death, a specter haunts investors – the specter of deflation. Despite central bankers’ attempts to push inflation rates higher, equity and commodity markets are collapsing. Inflation expectations as reflected in tanking U.S. Treasury yields, meanwhile, appear headed toward zero – and perhaps even below. “I think that we have a real danger of deflation in the economy right now,” former Trump economic advisor Stephen Moore told Fox Business’ Maria Bartiromo last weekend. Clearly, symptoms of deflation and leading indicators of economic contraction are now manifesting in dramatic ways:

Views:

99

|

|

Date:

20/03/12

|

|

We appear to be entering the sort of scenario that doomsday preppers have been warning about for years. A pandemic is spreading death and panic around the world. Markets are crashing. Store shelves are emptying… How long will it be before the economy grinds to a halt completely? How long will it be before the heavily leveraged financial system simply freezes up? Emergency rate cuts by the Federal Reserve won’t necessarily keep the banks open. Central bankers won’t necessarily keep grocery stores supplied with food. And they won’t necessarily help you and your family survive the present crisis. We don’t know if the worst is behind us or yet to come. The point of preparedness isn’t to try to predict when a crisis will hit or how long it will last. The point is to always be ready for a worst-case scenario. Why Bank Runs OccurYou don’t want to be among those lined up outside of a big box ... Read more »

Views:

294

|

|

Date:

20/03/11

|

|

Extreme volatility in the equity markets has investors wondering what to expect. Even the hardiest of stock market bulls are finally asking some serious questions about whether the top is in. Stocks have long been priced for perfection and suddenly conditions are looking far from perfect. The coronavirus may be the pin which pricks the latest Fed-blown bubble. Precious metals investors have been preparing against a rainy day. They may be less surprised by the turmoil in markets over the past couple of weeks. But there are still big questions about how metals prices might behave, especially if the current turmoil in markets should evolve into a full-blown financial crisis. Here are two metals-market scenarios worth considering: Scenario #1 - The 2008 Financial Crisis RevisitedDuring the immediate aftermath of the event, everything gets sold - a repeat of what happened in 2008. Investors buy ... Read more »

Views:

86

|

|

Date:

20/03/09

|

|

Another tumultuous week in equity and interest rate markets has helped fuel a big pop in safe-haven demand for gold and silver.

The major market moving event was, of course, the Federal Reserve’s emergency rate cut on Tuesday. The Fed slashed its overnight funds rate by 50 basis points. But even before the Fed acted, the bond market had already forced its hand as yields on the 10-year Treasury note plunged to record low levels. By Friday morning, the 10-year treasury yielded less than a paltry 0.90%. That represents almost no reward in exchange for the risk involved. Bond buyers are apparently willing to make a decade-long bet on U.S. government finances remaining solid and inflation remaining extremely low. It’s still possible for bonds to experience capital appreciation if rates ultimately head to zero or below – as they have already done in other parts of the world. The Fed is almost certain to cut rates again. There is a good ... Read more »

Views:

116

|

|

Date:

20/03/06

|

|

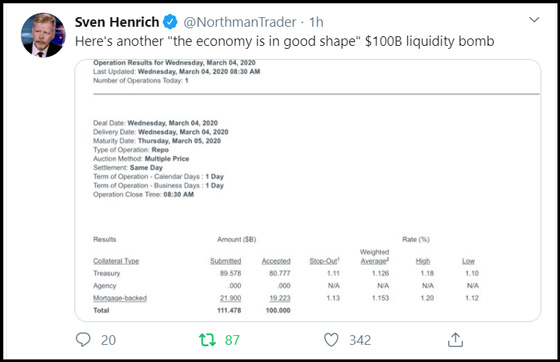

When investors become increasingly concerned about the financial system, they rush into physical precious metals. And, this is precisely what we see taking place at the U.S. Mint as sales of Silver Eagles surged in the first three days of March versus the entire month of February. The U.S. Mint hasn’t seen this type of buying for several years. For the past three years, annual Silver Eagle sales fell below 20 million, reaching a low in 2019. However, that may all change this year as the global contagion spreads, motivating investors to shed paper assets and move into physical precious metals. For sure, investors should be worried when the Fed starts to do “LIQUIDITY BOMBS” via its Repo Operations as stated by Sven Heinrich, the Northman Trader:

While the Primary Dealers submitted requests for $1 ... Read more »

Views:

77

|

|

Date:

20/03/05

|

|

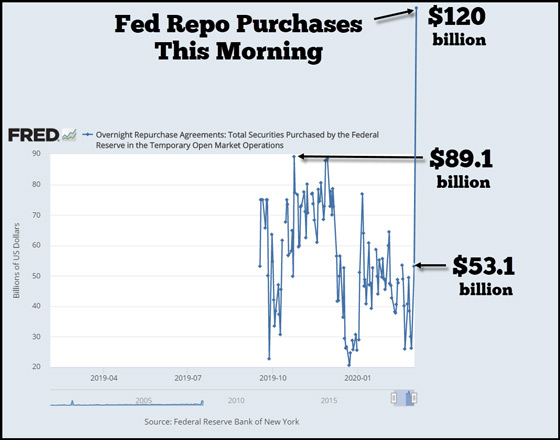

The Fed injected a record amount of liquidity this morning via its Repo Market Operation to supply dealers in the interbank market. While investors may be reassured by the huge 1293 point rally on the Dow yesterday, the global contagion and its impact are just beginning. Don’t be surprised to see a 40-50% correction in the Dow Jones over the next month. I’ve been keeping an eye on the Fed Repo Operations and was quite surprised this morning to see the Fed has already injected a record $120 billion into the market. Again, this is the largest single-day amount of Fed liquidity, going back to the first Repo Operation on September 17, 2019:

As you can see, I had to enlarge the chart to accommodate the Fed’s newest liquidity injection this morning… and the day isn’t over yet… ... Read more »

Views:

109

|

|

Date:

20/03/04

|